Chainlink Price Surges As $4.7M Buys Signal $35 Target Ahead

Chainlink (LINK) price has more strength now as people see growing prices, institutions buying more and markets becoming more positive.

Data reveals increased LINK token takeouts from trading platforms and increased trading activity in LINK futures which predicts an incoming price boost.

Trump’s World Liberty Purchases $4.7 Million in LINK

The Trump organization made a Link token purchase of 177,928 LINK tokens worth $4.7 million according to Lookonchain on January 20.

Market interest in LINK tokens continues to grow as traders buy more while the Core network operations improve.

Major investors see value in Chainlink’s platform after it proved stable despite market instability.

Despite short-term price drops LINK shows strength as buyers return to the $25-$26 price level.

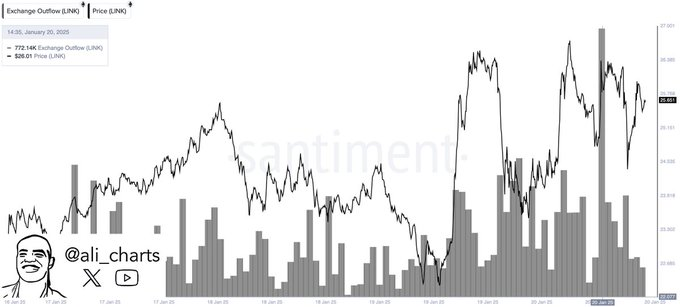

Over 770,000 LINK Tokens Withdrawn from Exchanges

Data from Santiment shows that 772,000 LINK tokens left crypto exchanges on January 20, 2025. Crypto analyst Ali believes holding or institutional entities are buying LINK tokens causing reduced market sell-off reports.

LINK’s price went up from $24.50 to $25.90 after people pulled their coins out of exchanges. Large token withdrawals may boost LINK’s price by pushing it toward resistance at $27-$30.

Chainlink Price Technical Analysis: Bullish Outlook Toward $35

LINK price action sees a 30% correction, which is a recurring pattern in its previous cycles where it corrected up to 30% before 15+ times. Analyst Michaël van de Poppe noted,

“$LINK has seen one of those standard 30% corrections… I’m expecting an upwards run towards $35 on Chainlink.”

RSI indicators reveal a strong upward trend in price despite the stock not signaling an overbought situation. The $19 to $20 threshold provides significant buying potential for traders but the stock meets probable resistance around $27 to $30 and $35.

Futures Market Sees Increasing Open Interest

According to Coinglass data, LINK futures open interest increased to $1.2 billion by January 2025. As new traders flock to the derivatives market to bet on potential LINK price movements, the use case continues to add more value.

The rise in LINK open interest started when prices began to recover in October 2024. Open interest growth signals market trust yet traders must keep an eye on potential losses that might happen if price starts moving downward.

At press time LINK price stood at $25.84 while investors traded $2.28 billion worth of assets and recorded a weekly increase of 28.54%.

Chain Activity and Institutional Buying is pumping the momentum for LINK, along with positive chart patterns that show it has runway to $35 as the next big obstacle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple CEO Reveals the Truth About the Amount of XRP on the Company's Balance Sheet

Tether to Build 70-Story Skyscraper in El Salvador, Symbol of Prosperity

Tech giants bounce back after AI disruption, S&P 500 nears record high

Share link:In this post: Last week, the largest tech firms in the US experienced huge challenges from Chinese AI, DeepSeek. Apple and Meta reported positive results, boosting the S&P 500. The Magnificent Seven’s price-to-earnings ratio is now 31.

OpenAI launches o3-Mini as it fights back against DeepSeek

Share link:In this post: OpenAI has launched its o3-Mini AI model to fight back against DeepSeek’s latest model. The company mentioned in its blog post that the o3-Mini is the most cost-efficient model in their reasoning series. DeepSeek’s breakthrough caused a $1 trillion tech selloff while putting pressure on AI chip makers.