Bitcoin OTC Desk Balances Hit Multi-Year Low as Exchange Activity Rises

- Bitcoin OTC reserves fell from 480,000 BTC in 2021 to 146,000 BTC, pushing institutions toward exchange-based purchases.

- Depleted OTC balances reduce options for discreet bulk trades, raising risks of price swings on public exchanges.

- Over 60,000 BTC moved last week signals rising exchange activity, potentially straining liquidity and amplifying short-term volatility.

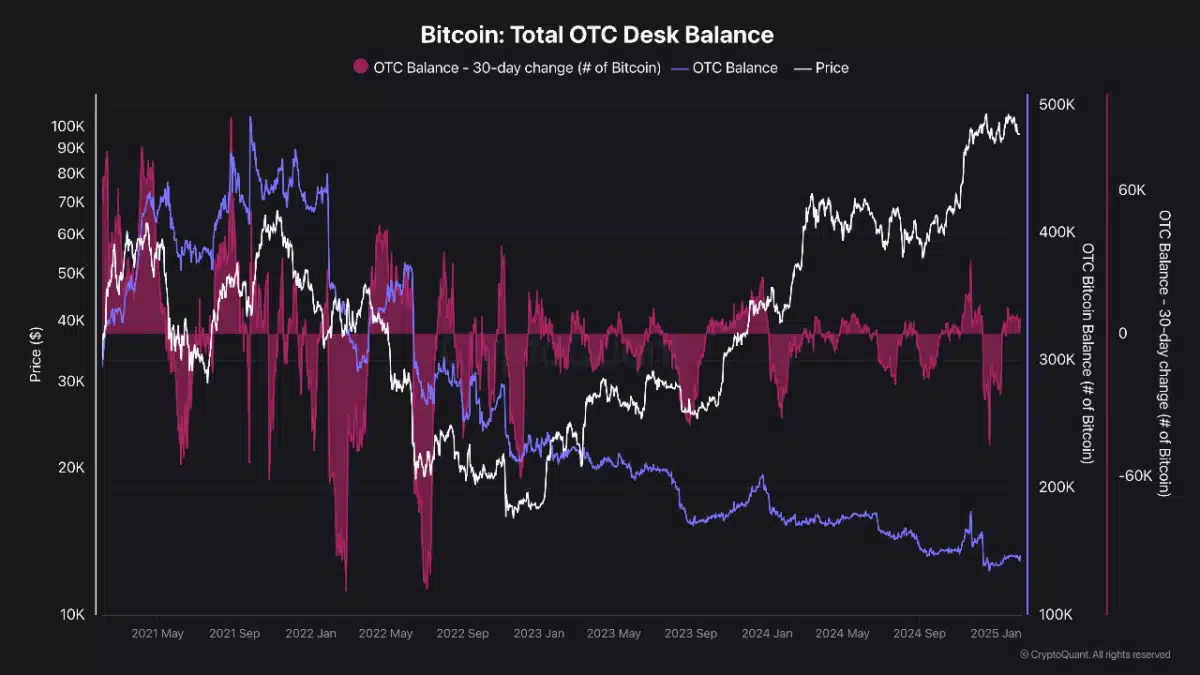

Bitcoin’s Over-The-Counter (OTC) trading desks now hold their smallest reserves since 2020, signaling a shift in how large investors acquire the asset. Data from analytics firm CryptoQuant reveals OTC balances dropped from 480,000 BTC in September 2021 to 146,000 BTC today, even as Bitcoin’s price climbed above $100,000. The decline reflects heightened institutional demand and a preference for executing bulk trades through private channels.

Source: CryptoQuant

Source: CryptoQuant

OTC desks allow institutions to buy or sell Bitcoin without triggering abrupt price changes. These platforms match large orders discreetly, avoiding the public order books of exchanges. However, the sharp reduction in available OTC Bitcoin suggests these reserves are being depleted faster than they’re replenished.

ETHNews analysts note that sustained institutional buying has likely contributed to the drawdown. With fewer coins accessible through OTC channels, institutions may increasingly turn to public exchanges for large purchases, exposing transactions to real-time market pricing.

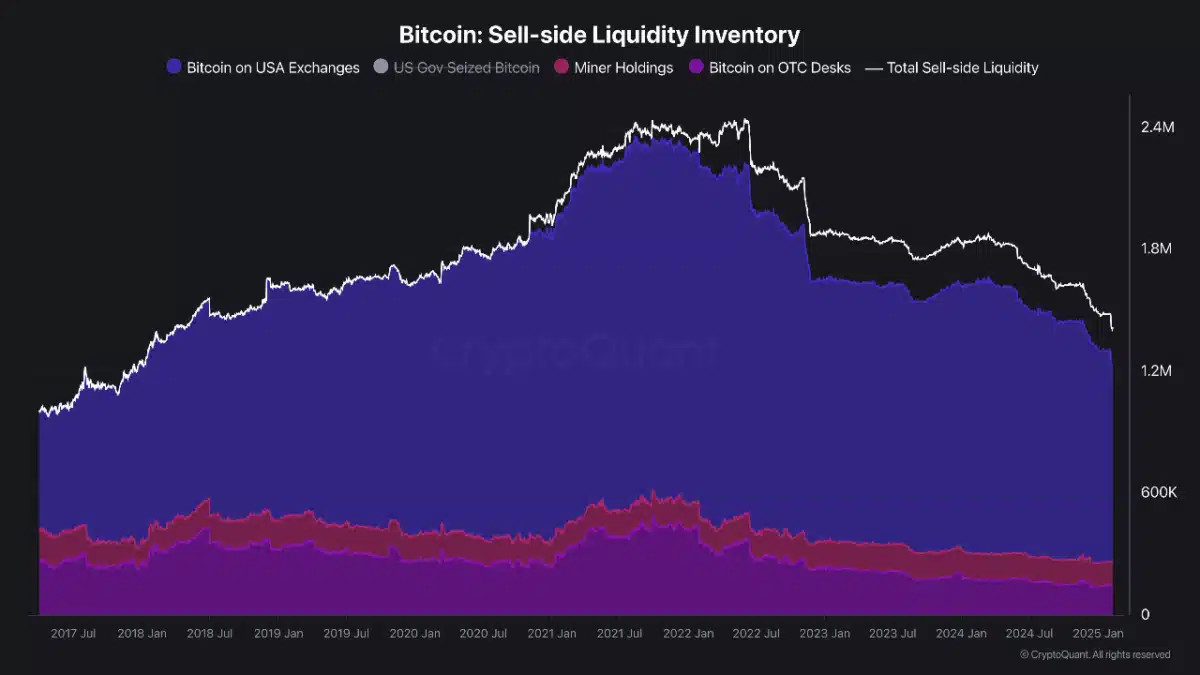

Source: CryptoQuant

Source: CryptoQuant

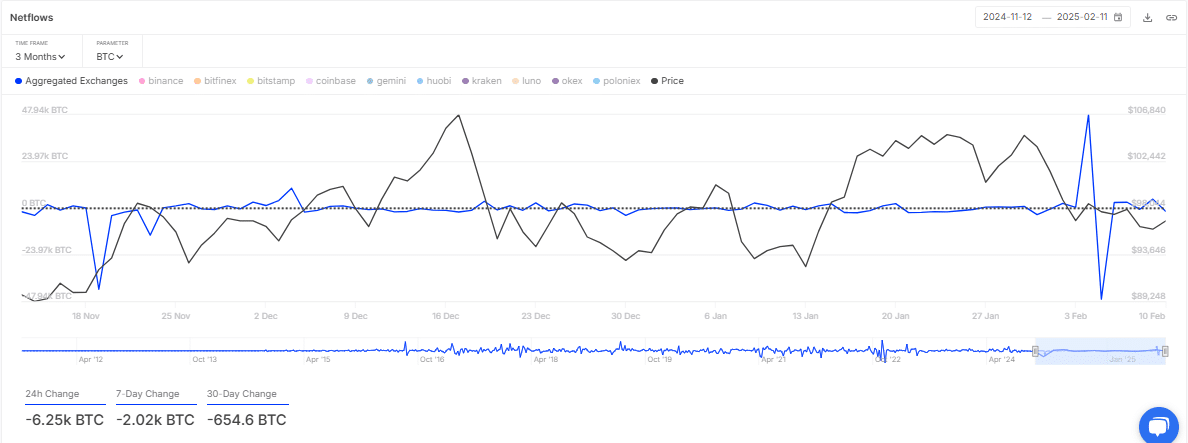

U.S.-based exchanges currently hold nearly 1 million BTC, providing ample liquidity for sellers. Yet, as OTC balances thin, large trades executed on exchanges could amplify price swings. Over 60,000 BTC moved between wallets in the past week alone, indicating heightened activity.

Source: IntoTheBlock

Source: IntoTheBlock

Such volume, when routed through exchanges, may create short-term volatility as orders interact with limited liquidity pools. While OTC desks once acted as buffers against market disruption, their diminishing role places more weight on exchange-driven price discovery.

This coincides with Bitcoin’s maturation as a regulated asset

Institutions now account for a larger share of trading volume , and their strategies increasingly align with traditional market behaviors. The move away from OTC reserves underscores a broader trend: Bitcoin’s liquidity is consolidating on regulated platforms, mirroring patterns seen in equities or commodities.

While this evolution may introduce new volatility risks , it also reflects growing institutional confidence in Bitcoin’s long-term viability. As the lines between crypto and traditional finance blur, exchange activity will likely set the tone for Bitcoin’s next phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Meme and AI token indices plummet 50% from December peaks while US and DeFi indices show resilience

The GMMEME and GMAI indices, for example, are down nearly 60% from their peaks in December.The following is an excerpt from The Block’s Data and Insights newsletter.

Could Litecoin Be the Next Big Runner? $1.5 Billion Volume Pushes LTC Up 12%

Litecoin ($LTC) has been propelled to the forefront of the altcoin market with rumours of an ETF approval.

Pepe Coin Crashes 65% but Traders Predict a Shocking 110% Rebound

Pepe (PEPE) shows signs of an upcoming trend reversal that could produce gains of over 100%

Why Is Stellar Dropping? XLM Turns Red as Market Shifts – What’s Next?

Stellar has been trading within a bullish flag pattern since the end of January, suggesting that it could stage a breakout very soon.