Research Report | JellyJelly Project Detailed Explanation & JELLYJELLY Market Value Analysis

西格玛学长2025/02/12 10:26

By:西格玛学长

I. Project introduction

JELLY-my-jelly (JELLYJELLY) is a Solana ecosystem MEME initiated by former Facebook Vice President of Product Sam Lessin, which integrates the dual genes of SocialFi and short video innovation. As an early core member of Facebook and Seed Capital of well-known projects such as Solana and Venmo, Sam Lessin injected strong endorsement into the project with his industry influence and resource network. JELLYJELLY is positioned as a "video chat content platform", claiming to be created by the original Venmo team, aiming to transform real-time conversations into spreadable short video content through AI technology, targeting the gap in the TikTok addressable market.

The technical architecture of the project revolves around AI-driven video creation, with core functions including real-time clip capture, intelligent transcription, multi-platform adaptation sharing, and AI-enhanced content generation. Through cloud storage management and deep social media API integration, users can convert video conversations into viral content adapted to platforms such as Instagram and TikTok with one click, emphasizing the product concept of "native interaction" replacing refined editing. Currently, the User Acceptance Testing stage covers 50-100 creators, including early users such as top blogger @nasdaily.

II. Project highlights

1. Endorsed by Silicon Valley's top resources, Solana's ecological MEME narrative

The outbreak of JELLYJELLY is not accidental, but driven by the personal halo of Sam Lessin (former Facebook product VP and Solana Seed Capital) and the Solana ecosystem traffic. From Lessin's rare token publishing link on the X platform, to CEX's rapid launch of spot trading, and then to the rumors of "Venmo team incubation" circulating in the community, a FOMO effect of "Silicon Valley elites reducing the dimension of coin issuance" has been formed.

2. Meme + SocialFi dual-wheel drive, undertaking Solana ecological traffic dividends

The trading volume of the token reached $350 million in the first hour of its launch. 26,000 holders include a large number of Solana community KOLs, forming a contrast between "Silicon Valley elites VS crypto grassroots", and the heat continues to spill over to traditional technology media. The project is benchmarked against the concept of "Vine Resurrection" (a substitute for the US version of TikTok), taking advantage of TikTok the North American regulatory crisis. If it is officially launched in the future, it will open up token and video creation incentives, forming a "traffic-token-functional privilege" flywheel, with imagination space far beyond pure Meme coins.

3. Seamless integration of AI video generation and social media

JellyJelly uses AI-driven video editing and transcription technology to automatically capture the highlights of users' video chats and perform transcription and content optimization. Users can directly share these clips to platforms such as Instagram, X (formerly Twitter), LinkedIn, and TikTok, greatly reducing the threshold for content creation. Compared to traditional video editing software, JellyJelly makes content creation smoother and more immediate, while enhancing the interactivity of video chats.

III. Market value expectations

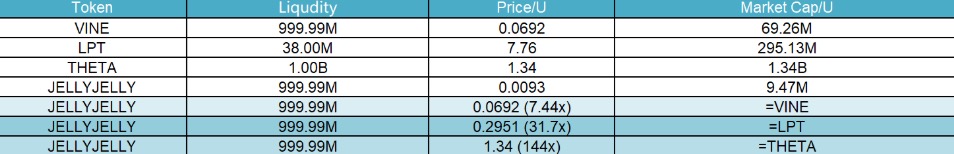

JELLYJELLY, as the Solana MEME project initiated by former Facebook product VP Sam Lessin, quickly gained attention in the market with its short video + Web3 + Meme storytelling. In the Short Video Platform and decentralized video streaming media track, there have been successful cases such as VINE, THETA, LPT, etc. JELLYJELLY's valuation can refer to the performance of these projects.

IV. Economic model

At present, the total supply of JELLYJELLY is 1 billion, the circulation quantity is about 999 million, and the circulation ratio is close to 100%.

The current market value is about $9.3M, the size of the on-chain liquidity pool is $2M (4,983.2 SOL), and the number of holders is 35,559.

The holding ratio of TOP 100 addresses is 74.84%. The market is still influenced by large investors, and changes in some addresses may have a significant impact on price trends.

According to the on-chain transaction data, the average buying price of TOP 100 addresses is 0.04346 dollars, and the current price is 78.62% lower than the average buying price, indicating that some large investors are still in a deep loss state.

The average selling price is 0.07403 dollars, 87.44% lower than the current price, which means that the previous large sellers generally completed transactions at a higher price.

Although the market has experienced a certain correction in the short term, the liquidity pool situation is stable, and no signs of large-scale withdrawal or rug have been found. The overall market environment is still within a controllable range. If JELLYJELLY can continue to expand community consensus and combine with SocialFi narrative to obtain more exchange support, its market value still has room for further growth.

V. Team & financing

Team information:

JELLYJELLY was initiated by former Facebook product VP Sam Lessin, and the team members include Solana ecosystem developers, former Venmo product team members, and social media operation experts. As the Seed Capital of well-known projects such as Solana, Venmo, and Aleo, Lessin attracted market attention early on with his rich industry experience and connections.

In terms of financing:

The token was listed through PUMP without any private placement, pre-sale or institutional financing. The initial liquidity of the project was fully invested by the market, and subsequent market value growth was entirely driven by open market transactions.

Ⅵ.Warning of latent risk

1. As a MEME project, JELLYJELLY's price fluctuates violently and is greatly influenced by market sentiment, community heat and KOL promotion. Investors need to be vigilant against short-term violent fluctuations and avoid FOMO chasing high or panic selling.

2. TOP 100 holdings account for 74.84%, and the market is still influenced by large investors. Although some large investors are still in a state of floating losses, future concentrated selling may cause market pressure and affect price stability.

VII. Official link

Website:https://www.jellyjelly.com/

Twitter:https://x.com/jellyvideochats

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Easing inflation could ignite another BTC rally: 10x Research

10x Research’s Markus Thielen sees a “real possibility” of a lower CPI print in the US on Feb. 12, which could defy consensus expectations and trigger a Bitcoin rally.

Cointelegraph•2025/02/12 08:37

TON integrates with interoperability protocol LayerZero

Coinjournal•2025/02/12 07:33

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$96,149.29

-1.73%

Ethereum

ETH

$2,635.4

-2.04%

Tether USDt

USDT

$1.0000

-0.02%

XRP

XRP

$2.43

-2.28%

Solana

SOL

$197.21

-2.64%

BNB

BNB

$646.53

+0.96%

USDC

USDC

$1.0000

-0.00%

Dogecoin

DOGE

$0.2579

-2.34%

Cardano

ADA

$0.7895

-2.63%

TRON

TRX

$0.2444

-1.58%

Bitget pre-market

Buy or sell coins before they are listed, including PLUME, J, and more.

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now