Bitcoin (BTC) Holds Key Support Following CPI Data Release: Is A Rebound Ahead?

Date: Wed, February 12, 2025 | 02:08 PM GMT

The cryptocurrency market experienced heightened volatility today following the release of U.S. CPI data for January 2025. Throughout the day, Bitcoin (BTC) maintained stability around $96,000, but the release of the latest Consumer Price Index (CPI) numbers by the Bureau of Labor Statistics (BLS) triggered a sharp decline in top assets including BTC and ETH.

CPI Data Triggers Market Reaction

The CPI rose by 0.1%, falling short of Wall Street’s 0.3% prediction. Year-over-year inflation stands at 2.9%, while core CPI—which excludes food and energy prices—rose to 3.3%, up from the previous 3.2%. This remains far from the Federal Reserve’s 2% target, signaling persistent inflationary pressures.

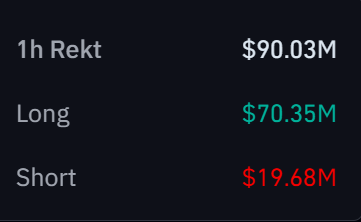

The crypto market reacted negatively to the report, leading to a spike in liquidations. Data from Coinglass shows that a total of $90 million was liquidated in the past hour, with $70 million coming from long positions.

Source: Coinglass

Source: Coinglass

Bitcoin Holds Key Support Zone

Despite the drop to low of $94,081, Bitcoin has managed to hold above a critical support zone around $91,000–$94,300. This level has previously acted as strong support during major market events, including the DeepSeek launch and Trump’s tariff announcements.

Bitcoin (BTC) Daily Chart/Coinsprobe (Source: Tradingview)

Bitcoin (BTC) Daily Chart/Coinsprobe (Source: Tradingview)

Currently, BTC is trading above $95,400, showing resilience at this level. As long as Bitcoin holds this key support, there is a strong possibility of a rebound.

The Moving Average Convergence Divergence (MACD) indicator is showing early signs of a potential reversal. If BTC maintains its footing above the support zone and managed to cross 100 SMA, a bounce back toward the $96,000–$97,500 range could be on the horizon. However, if the level breaks, further downside could be possible.

Final Thoughts

The market remains on edge as traders digest the CPI numbers. The coming days will be crucial for Bitcoin’s next move. If inflation concerns persist, volatility could increase, making risk management essential for traders.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct thorough research before making investment decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TAO and ONDO Approach Falling Wedge Resistance – Are Breakouts on Horizon?

FTT and LUNC Making Recovery From Recent Lows – Is a Trend Reversal on the Horizon?

QUBIC and USTC Approach Key Resistance – Could Breakouts Spark a Rally?