Bitget: Top 4 in global daily trading volume!

BTC market share58.54%

Altcoin season index:0(Bitcoin season)

BTC/USDT$99220.67 (-2.58%)Fear and Greed Index60(Greed)

Total spot Bitcoin ETF netflow +$318.6M (1D); +$1.27B (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Top 4 in global daily trading volume!

BTC market share58.54%

Altcoin season index:0(Bitcoin season)

BTC/USDT$99220.67 (-2.58%)Fear and Greed Index60(Greed)

Total spot Bitcoin ETF netflow +$318.6M (1D); +$1.27B (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Top 4 in global daily trading volume!

BTC market share58.54%

Altcoin season index:0(Bitcoin season)

BTC/USDT$99220.67 (-2.58%)Fear and Greed Index60(Greed)

Total spot Bitcoin ETF netflow +$318.6M (1D); +$1.27B (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

The Infinite Garden priceETH

Quote currency:

USD

$0.0038360.00%1D

Last updated 2025-02-02 14:59:56(UTC+0)

Market cap:--

Fully diluted market cap:--

Volume (24h):$791.36

24h volume / market cap:0.00%

24h high:$0.004547

24h low:$0.004547

All-time high:$0.2676

All-time low:$0.0009997

Circulating supply:-- ETH

Total supply:

10,000,000ETH

Circulation rate:0.00%

Max supply:

10,000,000ETH

Contracts:

0x5e21...378d613(Ethereum)

More

How do you feel about The Infinite Garden today?

Note: This information is for reference only.

Price of The Infinite Garden today

The live price of The Infinite Garden is $0.003836 per (ETH / USD) today with a current market cap of $0.00 USD. The 24-hour trading volume is $791.36 USD. ETH to USD price is updated in real time. The Infinite Garden is 0.00% in the last 24 hours. It has a circulating supply of 0 .

What is the highest price of ETH?

ETH has an all-time high (ATH) of $0.2676, recorded on 2024-03-13.

What is the lowest price of ETH?

ETH has an all-time low (ATL) of $0.0009997, recorded on 2024-01-14.

The Infinite Garden price prediction

What will the price of ETH be in 2026?

Based on ETH's historical price performance prediction model, the price of ETH is projected to reach $0.004578 in 2026.

What will the price of ETH be in 2031?

In 2031, the ETH price is expected to change by +13.00%. By the end of 2031, the ETH price is projected to reach $0.01181, with a cumulative ROI of +174.10%.

The Infinite Garden price history (USD)

The price of The Infinite Garden is -81.26% over the last year. The highest price of in USD in the last year was $0.2676 and the lowest price of in USD in the last year was $0.003703.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h0.00%$0.004547$0.004547

7d-26.51%$0.004547$0.006187

30d-10.25%$0.004421$0.008803

90d-16.54%$0.004421$0.01104

1y-81.26%$0.003703$0.2676

All-time-94.90%$0.0009997(2024-01-14, 1 years ago )$0.2676(2024-03-13, 326 days ago )

The Infinite Garden market information

The Infinite Garden's market cap history

The Infinite Garden holdings by concentration

Whales

Investors

Retail

The Infinite Garden addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

The Infinite Garden ratings

Average ratings from the community

5

This content is for informational purposes only.

ETH to local currency

1 ETH to MXN$0.081 ETH to GTQQ0.031 ETH to CLP$3.791 ETH to HNLL0.11 ETH to UGXSh14.141 ETH to ZARR0.071 ETH to TNDد.ت0.011 ETH to IQDع.د5.031 ETH to TWDNT$0.131 ETH to RSDдин.0.431 ETH to DOP$0.241 ETH to MYRRM0.021 ETH to GEL₾0.011 ETH to UYU$0.171 ETH to MADد.م.0.041 ETH to OMRر.ع.01 ETH to AZN₼0.011 ETH to KESSh0.51 ETH to SEKkr0.041 ETH to UAH₴0.16

- 1

- 2

- 3

- 4

- 5

Last updated 2025-02-02 14:59:56(UTC+0)

How to buy The Infinite Garden(ETH)

Create Your Free Bitget Account

Sign up on Bitget with your email address/mobile phone number and create a strong password to secure your account.

Verify Your Account

Verify your identity by entering your personal information and uploading a valid photo ID.

Buy The Infinite Garden (ETH)

Use a variety of payment options to buy The Infinite Garden on Bitget. We'll show you how.

Join ETH copy trading by following elite traders.

After signing up on Bitget and successfully buying USDT or ETH tokens, you can also start copy trading by following elite traders.

The Infinite Garden news

Bitcoin Drops Below $100K as Market Weakness Grows

Cryptodnes•2025-02-02 13:00

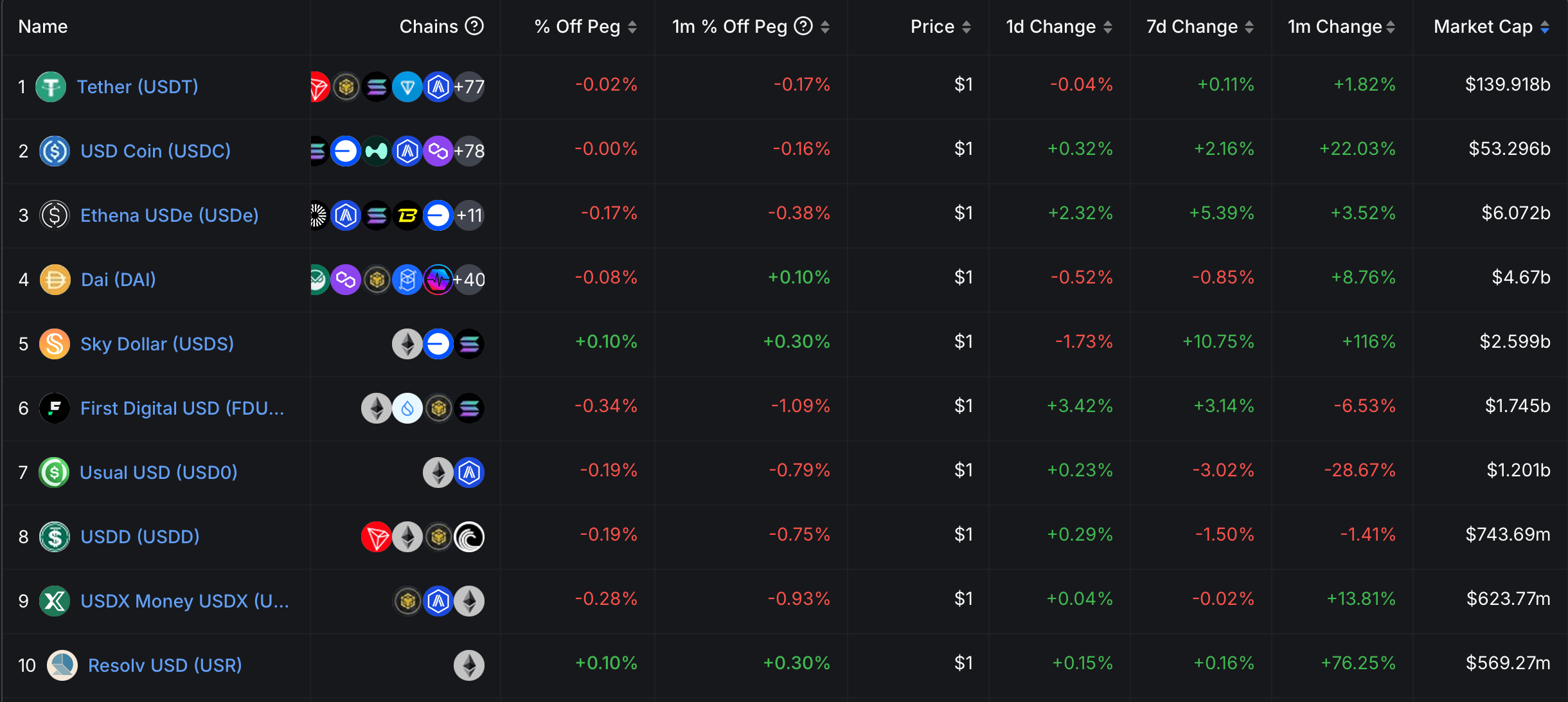

Stablecoins Quietly Balloon by $14B in January — Who’s Leading the Charge?

CryptoNewsNet•2025-02-02 10:11

Ethereum network gas fee drops below 2 gwei

Bitget•2025-02-02 10:03

ETH falls below $3,100

Cointime•2025-02-02 09:56

Buy more

FAQ

What is the current price of The Infinite Garden?

The live price of The Infinite Garden is $0 per (ETH/USD) with a current market cap of $0 USD. The Infinite Garden's value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. The Infinite Garden's current price in real-time and its historical data is available on Bitget.

What is the 24 hour trading volume of The Infinite Garden?

Over the last 24 hours, the trading volume of The Infinite Garden is $791.36.

What is the all-time high of The Infinite Garden?

The all-time high of The Infinite Garden is $0.2676. This all-time high is highest price for The Infinite Garden since it was launched.

Can I buy The Infinite Garden on Bitget?

Yes, The Infinite Garden is currently available on Bitget’s centralized exchange. For more detailed instructions, check out our helpful How to buy guide.

Can I get a steady income from investing in The Infinite Garden?

Of course, Bitget provides a strategic trading platform, with intelligent trading bots to automate your trades and earn profits.

Where can I buy The Infinite Garden with the lowest fee?

Bitget offers industry-leading trading fees and depth to ensure profitable investments for traders. You can trade on the Bitget exchange.

Where can I buy The Infinite Garden (ETH)?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Cryptocurrency investments, including buying The Infinite Garden online via Bitget, are subject to market risk. Bitget provides easy and convenient ways for you to buy The Infinite Garden, and we try our best to fully inform our users about each cryptocurrency we offer on the exchange. However, we are not responsible for the results that may arise from your The Infinite Garden purchase. This page and any information included are not an endorsement of any particular cryptocurrency. Any price and other information on this page is collected from the public internet and can not be consider as an offer from Bitget.

Bitget Insights

Hustler🥰

3h

Ethereum (ETH) has surged from $3,050 to $3,400 in less than three days, igniting fresh optimism amo

Ethereum (ETH) has surged from $3,050 to $3,400 in less than three days, igniting fresh optimism among investors who believe ETH is poised for significant gains this year. After weeks of uncertainty and selling pressure, Ethereum’s latest price action has renewed bullish sentiment, with analysts predicting further upside.Related Reading: U.S. Bitcoin ETFs Hold 5.87% Of Supply As Investor Demand Stays Strong Above $100KKey on-chain metrics from IntoTheBlock support this outlook, revealing that Ethereum has an average holding time of 2.4 years, signaling strong confidence from long-term holders. This data suggests that despite short-term volatility, Ethereum investors remain committed, reinforcing the idea that ETH could see a sustained rally as market conditions improve. With bullish momentum building, all eyes are now on critical resistance levels, which, if broken, could push Ethereum toward multi-month highs. However, investors remain cautious, as Ethereum still needs to reclaim its previous all-time highs to fully confirm a new bullish phase. The coming weeks will be crucial in determining whether ETH can maintain its uptrend and outperform the broader market in 2024.Ethereum Faces Uncertainty But LTHs Show ConfidenceEthereum has been in a persistent downtrend since late December, with its price falling over 28% from local highs of $4,100. Compared to Bitcoin’s performance, ETH has underwhelmed investors, leading to speculation that 2024 could be another “bad year” for the second-largest cryptocurrency.Despite these concerns, on-chain data from IntoTheBlock suggests a different outlook. Metrics reveal that Ethereum’s average holding time is 2.4 years, highlighting strong confidence from long-term holders. This indicates that despite the current price struggles, ETH investors continue to accumulate and hold, anticipating future gains. Ethereum Holders by Time held | Source: IntoTheBlock on XHowever, Ethereum’s growth potential appears somewhat tempered as Layer 2 solutions (L2s) and alternative Layer 1 (L1) blockchains continue to fragment attention and adoption. Newer investors and developers are exploring competing ecosystems, leading to a lack of fresh short-term participants in ETH’s network. This shift has created uncertainty around whether ETH can maintain its dominant position in the altcoin space.Related Reading: Bitcoin Monthly Realized Volatility Sits Below Cycle Peak Levels – Room For A Breakout?The coming weeks will be crucial for ETH, as February has historically been a bullish month for the asset. If Ethereum can reclaim key resistance levels and attract new demand, a reversal could be on the horizon, offering investors renewed confidence in its long-term potential. ETH Price Outlook: Key Levels To WatchEthereum (ETH) is currently trading at $3,320 after a volatile Friday that saw the price surge to $3,448 before retracing below $3,300. Despite the price swings, ETH looks strong and poised to break out of its downtrend.If bulls can hold above the $3,300 mark and push past $3,500 over the weekend, ETH could enter a massive rally toward the $4,000 level. This would signal a trend reversal, attracting fresh demand and reigniting investor confidence.ETH pushing above key levels | Source: ETHUSDT chart on TradingViewHowever, the risk of further consolidation or even a correction remains. If ETH fails to maintain current support levels, it could lead to increased selling pressure, pushing the price back to test lower demand zones. Losing the $3,200 mark would indicate weakness, potentially delaying Ethereum’s bullish breakout.Related Reading: Bitcoin Retail Activity Drops 48% In 3 Months –$ETH

SPACE0.00%

HOLD0.00%

MASTER-SIGNALS

4h

Nuts Coin quick buy now last chance 🚀🚀🚀$NEIROETH $BLASTUP $BTC $DOGS $TRUMP $MELANIA $U2U $HOLDCOIN $SPELL $WAT $WOOF $NC $GEEK $ETH $HOLDCOIN $AARK $MDOGS $CEC $AKRO $LIFEFORM $BLASTUP

BTC0.00%

MELANIA0.00%

Shaxy

4h

As Bitcoin [BTC] and other top cryptos consolidated their dominance, altcoins have been left struggling for relevance. The chart shows a steady decline in the dominance of altcoins outside the top 10 over the years.

This diminishing focus on smaller tokens stems from Bitcoin’s growing reputation as a “safe haven” asset and Ethereum’s dominance in smart contract applications.

Both giants have captured the lion’s share of market capitalization, leaving limited room for speculative altcoin surges.

With institutional investments and increasing public trust flowing predominantly toward the top players, the days of altcoins driving market excitement might be waning.

The exponential rise in the number of unique crypto tokens highlights a major shift in the market landscape. Since 2017, the sheer volume of token creation has surged, surpassing 30 million unique tokens by late 2024.

This rapid growth has fragmented investor attention and diluted capital allocation.

Platforms like Solana [SOL], Ethereum [ETH], and Polygon [POL] continue to dominate token creation, but the overwhelming supply of new projects has made it increasingly difficult for individual tokens to gain traction.

As more tokens flood the market, questions about quality, utility, and long-term viability emerge, making it harder for investors to distinguish between promising altcoins and fleeting trends.

While Bitcoin has traditionally been the dominant force in the crypto space, its market cap trajectory diverged sharply from other cryptocurrencies post-2022.

Bitcoin reached a market cap exceeding $2 trillion in 2024, maintaining a steady climb despite volatility in the broader crypto market.

Conversely, other cryptocurrencies experienced significant fluctuations, with their collective market cap lagging behind Bitcoin.

This decoupling further proves Bitcoin’s unique role as a store of value and highlights fragmentation in the altcoin market.

The persistent dominance of Bitcoin raises questions about the future of “altseason.”

Bitcoin’s market cap keeps rising, while altcoins remain volatile and fragmented, reflecting reduced confidence or a shift toward quality.

Yet, innovation in altcoins, driven by new use cases and blockchain progress, hints at potential for a delayed resurgence.

Altseason may not be over, but it may need broader market stability and maturing altcoin projects to challenge Bitcoin’s dominance.$ALT

BTC0.00%

ALT0.00%

Shaxy

4h

Lido DAO [LDO] has successfully broken above its descending triangle, fueling optimism among traders. This breakout is a confirmation of strong buying pressure, with price targets set around $2.80 and possibly $3.20, if momentum continues.

At press time, LDO was trading at $2.29, reflecting a 6.95% hike in the last 24 hours. With resistance levels still ahead, will the bullish momentum push LDO higher, or is a correction on the charts imminent?

Lido’s permissionless home staking is revolutionizing Ethereum’s staking landscape. Unlike traditional models that require 32 ETH, Lido allows users to stake smaller amounts without relying on centralized validators. This approach increases decentralization while enhancing accessibility for smaller investors.

Additionally, permissionless staking broadens Ethereum’s security by distributing validation power across a wider network. As Ethereum moves towards a fully decentralized staking ecosystem, Lido continues to lead the charge. Therefore, growing adoption of this system could significantly boost LDO’s value in the long run.

LDO has successfully broken out of a descending triangle, a pattern that often signals a trend reversal. The immediate challenge lies at $2.42 – A key resistance level that bulls must clear. If buyers push past this zone, LDO could quickly rally towards $2.80 and eventually, $3.20.

However, if the price fails to hold above this breakout level, a retest of $2.10 remains possible. Additionally, increasing trading volume may be a sign that momentum is building, making the next few days crucial for LDO’s short-term trajectory.

On-chain data revealed a 58.54% spike in new addresses, signaling growing retail participation. Moreover, active addresses surged by 52.21%, indicating that more traders are engaging with LDO. Historically, rising address activity has correlated with bullish price action.

Furthermore, such a hike in adoption can also mean rising confidence in Lido’s staking ecosystem. Therefore, if address growth continues at this pace, it could support further price appreciation.

Transaction data highlighted a significant hike in large transfers. Notably, $100k-$1M transactions rose by 291.43% – A sign that institutional players and whales have been accumulating.

Additionally, mid-sized holders have been increasing their exposure too, further reinforcing bullish sentiment. Higher accumulation from deep-pocketed investors often leads to price stability and potential breakouts.

Despite LDO’s bullish breakout, the Price DAA divergence dropped sharply to -99.11% – A sign of weakening network activity, relative to price movement.

A steep negative divergence usually means that price growth is not being supported by increasing active addresses. This could potentially signal a slowdown.

Given Lido’s bullish breakout, increasing address activity, and rising institutional accumulation, LDO has a strong chance of hitting $3.20.

However, breaking $2.42 remains crucial for confirming further upside. If bulls sustain momentum, higher price targets may be likely. Therefore, LDO’s next move will depend on whether buyers can push past its resistance or face a temporary pullback. $LDO

HOLD0.00%

MOVE0.00%

Mano-Billi

5h

Ethereum's January performance was undoubtedly bearish, but there's a glimmer of hope for February. The price, currently at $3,102.42 ¹, shows signs of a potential wedge pattern breakthrough, which could lead to increased volatility.

A breakout attempt was made during Friday's trading session, with the price briefly surpassing the descending resistance line, indicating a surge in bullish expectations. However, the bulls were quickly countered, and ETH closed the day within the descending resistance line, suggesting that momentum wasn't strong enough to exit the wedge pattern.

Despite this, there's excitement brewing in both the spot and derivatives markets. Volume has increased by 70.92% to $54.35 billion in the last 24 hours, and open interest has surged by 1.73%. Spot inflows peaked at $80.35 million on Friday, with ETH net outflows dominated by $45.29 million in the last 24 hours.

*Key Factors to Watch:*

- _Exchange Outflows_: A surge in exchange outflows could manifest within the squeeze zone, indicating demand outweighing sell pressure.

- _Institutional Investment_: BlackRock's acquisition of 24,529 ETH worth roughly $83.24 million could signal a bias in favor of the bulls.

- _Spot and Derivatives Inflows_: A spike in both spot and derivatives inflows underscores positive developments, potentially leading to a bullish start this month.

While these findings may boost sentiment, investors should exercise caution due to potential unknown downside risks.

ETH0.00%

OPEN0.00%

Related assets

Popular cryptocurrencies

A selection of the top 8 cryptocurrencies by market cap.

Recently added

The most recently added cryptocurrencies.

Comparable market cap

Among all Bitget assets, these 8 are the closest to The Infinite Garden in market cap.